Your Credit Report – Understanding what’s in it

Credit Report is defined as a record of an individual’s or company’s borrowing and repaying, including information about late payments and bankruptcy. In the U.S., when a consumer fills out an application for credit from a bank, store or credit card company, their information is forwarded to a credit bureau. The credit bureau matches the name, address and other identifying information on the credit applicant with information retained by the bureau in its files.

What’s in your report?

Although each credit reporting agency formats and reports this information differently, all reports contain the same categories of information.

- Identifying Information. Your names, addresses, Social Security number, date of birth and employment information are used to identify you. These factors are not used in credit scoring. Updates to this information come from information you supply to lenders.

- Trade Lines. These are your credit accounts. Lenders report on each account you have established with them. They report the type of account (bankcard, auto loan, mortgage, etc), the date you opened the account, your credit limit or loan amount, the account balance and your payment history.

- Credit Inquiries. You authorize your lender to ask for a copy of your report when you apply for a loan. This is how inquiries appear on your report. The inquiries section contains a list of everyone who accessed your report within the last two years. The report you see lists both “voluntary” inquiries, spurred by your own requests for credit, and “involuntary” inquires, such as when lenders order your report to send you a pre-approved offer in the mail.

- Public Record and Collection Items.

- Credit reporting agencies also collect public record information from state and county courts, and information on overdue debt from collection agencies. Public record information includes bankruptcies, foreclosures, suits, wage attachments, liens and judgments.

Types of Credit

Secured credit

This type of credit is supported by some form of collateral. For example if you use credit to purchase a car, you have use and possession of the car however the lender retains the title to the car as collateral for the loan amount. Until the loan is repaid in full the car title is held to insure payment and lessen the risk of loss. In the event of non- payment the lender can take the car and sell it to satisfy the debt. The same principal applies to the purchase of a home.

Unsecured credit

Unlike secured credit this type of credit relies solely on the borrower to repay the entire amount plus interest. Credit Cards are the most common form of unsecured credit. If a borrower fails to pay an unsecured loan (e.g. credit card), the creditor can go to court and obtain a judgment to recover the debt.

Installment Credit

Installment credit can be secured or unsecured and is paid back over a specific period of time. When lenders are deciding whether or not to make an installment loan they consider several factors about the borrower’s creditworthiness. The terms, rates and fees are determined by looking at the borrower’s status in the credit rating system.

Non-Installment

Non-installment credit is repaid all at once on a specific date. This is often referred to as COD (cash on delivery). Most utility services and medical and professional service providers use, this method since it limits possible losses. In some cases consumers with limited or bad credit must use this method since they lack credit ability.

There are several other variations and combinations of these options, but for this section we will only take a look at the following major types of consumer credit.

- 1. Bank Cards are issued to consumers; many have a variety of fees that are billed directly to the cardholder. Remember all cards have different policies and fees depending on the user’s creditworthiness, pay history and income.

- 2. Travel and Entertainment (ex. American Express) although these cards can be used for nearly all the purchases made by a consumer, the rates and terms can be very different from other cards.

- 3. Merchant/Store Cards are often issued directly by retail stores. These types of cards give the merchant the option to leverage the buying power of their customer/cardholder. In addition, they are able to adjust rates and terms to meet market demands while catering to customer purchasing habits. These types of cards are often used by merchants to increase sales by offering lots of incentives to make purchases.

- 4. Debit Cards “Non-Credit Cards” or ATM cards look just like credit cards. However, each purchase using the card is deducted directly from the consumer’s bank account.

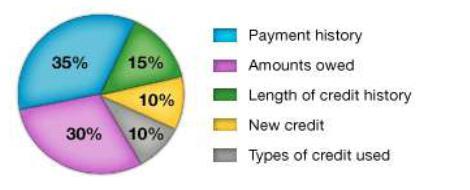

What is calculated?

Payment history is 35% of your credit score.

Lenders are most concerned about whether or not you pay your bills. The best indicator of this is how you’ve paid your bills in the past. Late payments, collections, and bankruptcies all affect the payment history of your credit score. More recent delinquencies hurt your credit score more than those in the past.

Debt level is 30% of your credit score.

The amount of debt you have in comparison to your credit limits is known as credit utilization. The higher your credit utilization – the closer you are to your limits – the lower your score will be. Keep your credit card balances at about 30% of your credit limit or less. Length of credit history is 15% of your credit score. Having a longer credit history is favorable because it gives more information about your spending habits. It’s good to leave open the accounts that you’ve had for a long time.

Inquiries are 10% of your credit score.

An inquiry is added to your credit report each time you make an application for credit. Too many applications for credit can mean that you are taking on a lot of debt or that you are in some kind of financial trouble. While inquiries can remain on your report for two years, your credit score calculation only considers those made within a year.

Mix of credit is 10% of your credit score.

Having different kinds of accounts is favorable because it shows that you have experience managing a mix of credit. This isn’t a significant factor in your credit score unless you don’t have much other information on which to base your score. Open new accounts as you need them, not to simply have what seems like a better mix of credit.

How long do items stay on your report?

Many people who have negative information on their report ask how long these items can stay on their report. The answer can vary depending on the type of account, and the associated activity on said account. A general rule of thumb is that typical paid revolving and installment accounts stay on your report for 7 years from the date of last activity.

Most bankruptcies will remain on your report for 10 years. Tax liens remain on your report for 7 years from the date they were paid. Lawsuit or judgment information is typically reported for 7 years, and credit inquiries typically stay on your report for about 2 years.

Here’s a list of how long negative items stay on your report:

- Bankruptcy Chapter 13: 7 years from the filing date

- Bankruptcy Chapter 7, 11, or 12: 7 years on credit report with additional 3 years in public record

- Charge off: 7 years from the date of original delinquency

- Collection: 7 years from date of original delinquency

- Credit Inquiries: 2 years

- Foreclosure: 7 years from filing date

- Judgment: 7 years from date it was reported

- Paid Tax Lien: 7 years from date paid

- Paid and Closed Revolving/Installment Accounts: 10 years

- Unpaid Tax Lien: 15 years

- Positive information may remain on your report indefinitely, unless the account is closed or inactive.

Important Note

Your credit report has a field labeled “Date of Status.” This is the date of the last activity. The point of last activity is when you made your last payment or purchase. For example, let’s say that your last payment on an account is in May of 2005, the account goes to collections and you make a payment in March of 2010. The seven year period starts again from March of 2010 and the account will not be removed from your report until March 2017. Also note that collection accounts and charge-offs will remain on your report for 7 years whether they are paid or not. If you pay them, it will simply change the status to paid, but the account(s) will still remain on your report. The only way you can legally remove collections and charge-offs any earlier is to write a dispute letter to the credit bureaus claiming the information is reporting in error or getting the debts settled for deletion. Information is collected differently by the three main credit bureaus, and they may vary in how long they report information, and how they report information. That is why it is important to get a tri-merge credit report that contains information for all three credit bureaus.